stochastic processes - Modelling EUR/USD rate with Ornstein-Uhlenbeck model - Quantitative Finance Stack Exchange

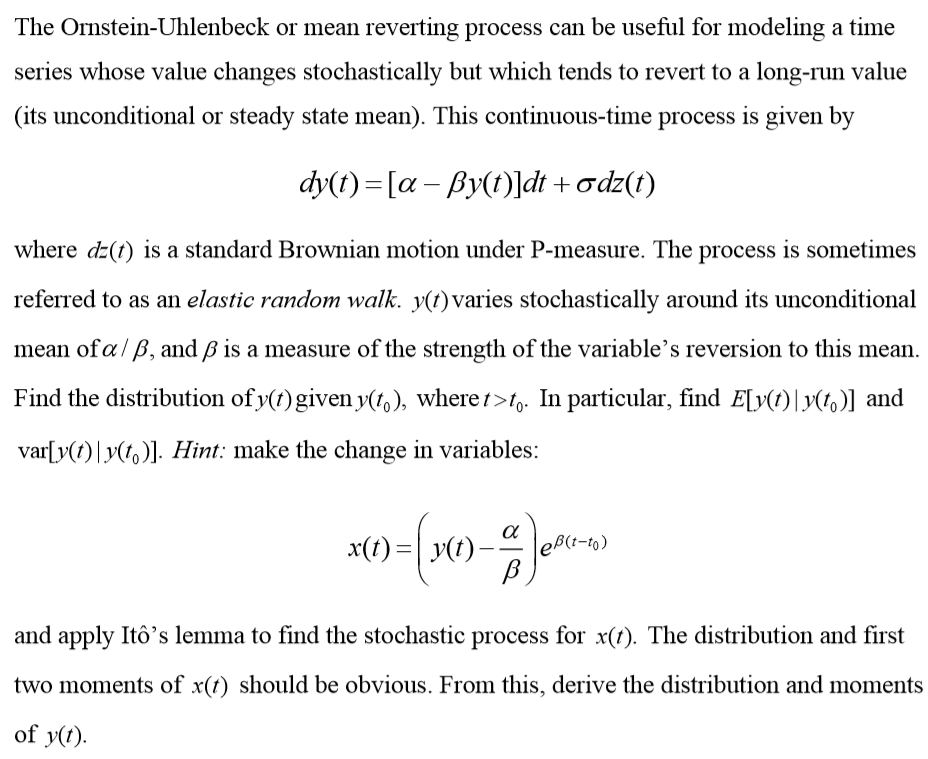

Stochastic Differential Equations —The Ornstein-Uhlenbeck Process | by Ryan Howe | Star Gazers | Medium

Beyond Brownian motion and the Ornstein-Uhlenbeck process: Stochastic diffusion models for the evolution of quantitative characters | bioRxiv

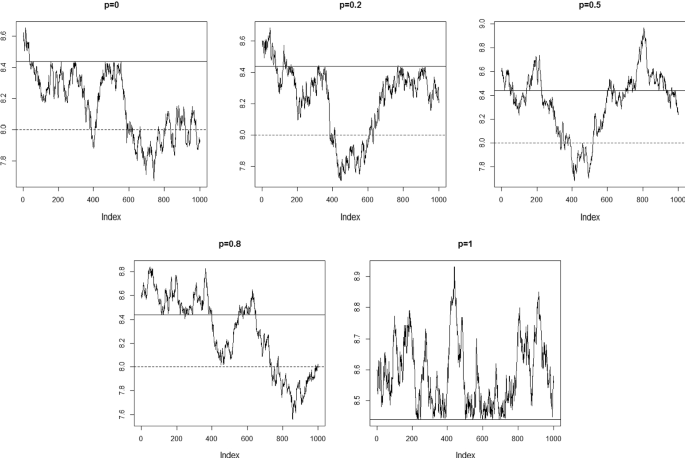

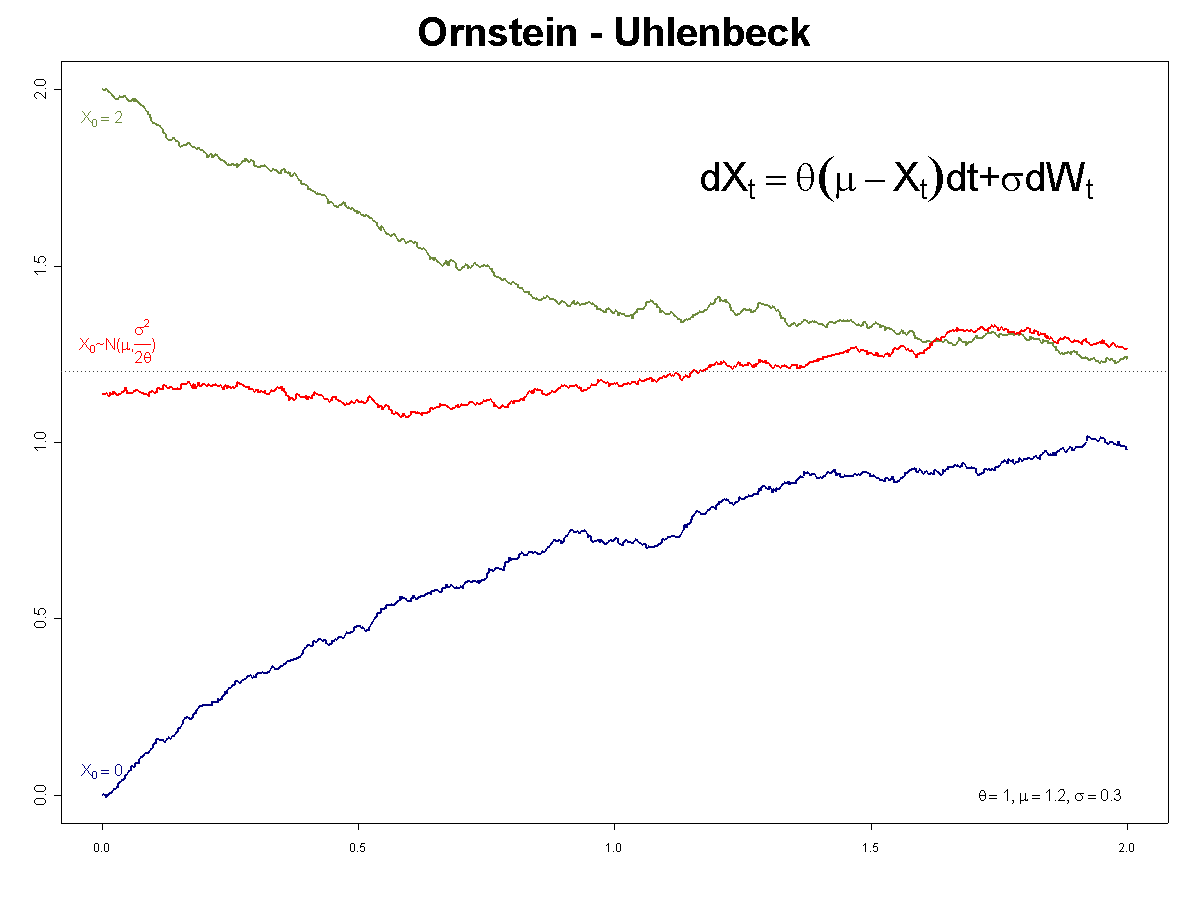

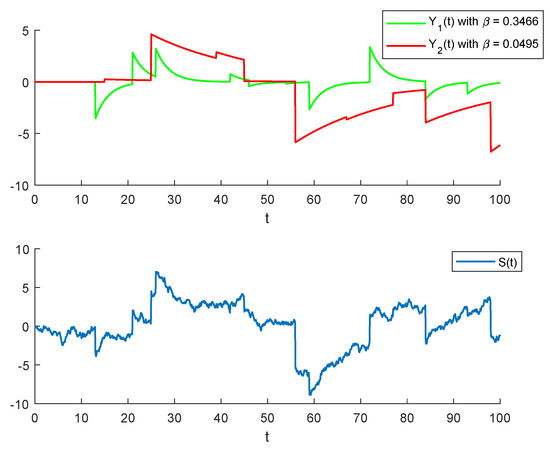

1: Trajectory Ornstein Uhlenbeck process; observe the reversion (rate β... | Download Scientific Diagram

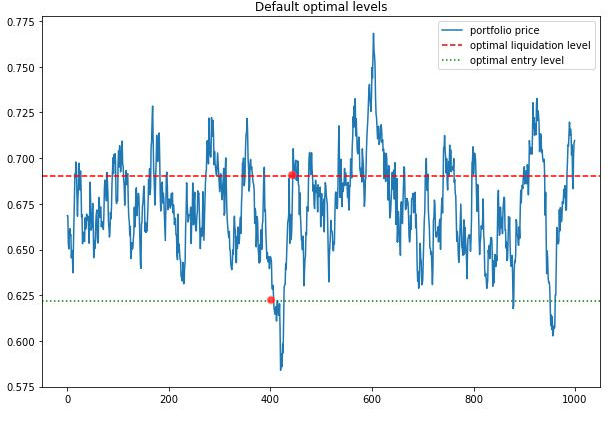

Risks | Free Full-Text | The Effect of Mean-Reverting Processes in the Pricing of Options in the Energy Market: An Arithmetic Approach | HTML